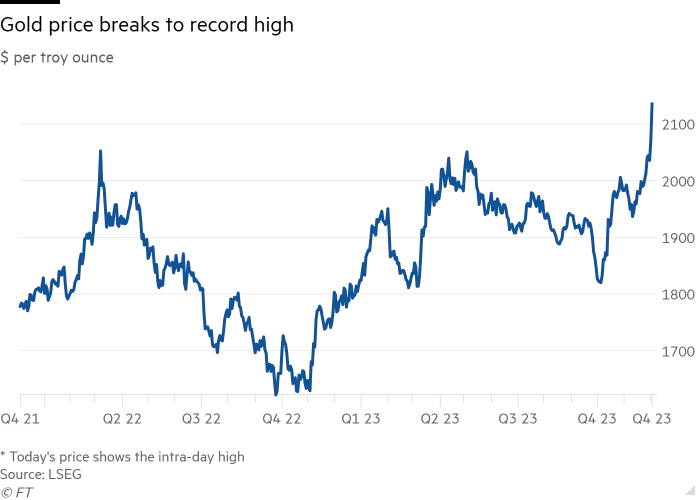

Gold prices surged to a new all-time high on Friday, December 1, 2023, as traders increased their bets that the U.S. Federal Reserve would start cutting interest rates by March 2024, amid signs of slowing inflation and economic growth.

Spot gold climbed 1.6% to $2,069.10 per ounce, breaking the previous record of $2,072.49 set in 2020. Prices were up 3.4% for the week, marking the third consecutive weekly gain. U.S. gold futures also settled 1.6% higher at a record peak of $2,089.7.

The rally in gold was triggered by the remarks of Fed Chair Jerome Powell, who spoke at Spelman College in Atlanta on Thursday, November 30, 2023. Powell said that “the risks of under- and over-tightening are becoming more balanced”, but that the Fed was not thinking about lowering rates right now. He also said that “it was premature to speculate on easing rates”, and that the Fed would need “substantially more evidence” before changing its policy stance.

However, the market interpreted Powell’s comments as a signal that the Fed had completed its monetary policy tightening cycle, and that it was preparing to shift to a more dovish stance in the near future. The market also reacted to the latest data on U.S. inflation and GDP, which showed that consumer prices rose 5.4% year-on-year in November, down from 5.9% in October, while the economy grew at an annualized rate of 2.1% in the third quarter, down from 6.7% in the second quarter.

These figures suggested that the U.S. economy was losing momentum, and that inflation was cooling off, reducing the need for the Fed to raise interest rates further. The market also expected that the Fed would face more pressure to ease its policy in the coming months, as the U.S. faced several challenges, such as the new Omicron variant of the coronavirus, the debt ceiling deadline, the trade tensions with China, and the midterm elections.

As a result, the market increased its bets that the Fed would start cutting interest rates by March 2024, and that the interest rate would be below 4% by the end of 2024. The Fed funds rate currently stands at 5.25%-5.50%. The market also priced in a 50% chance of a rate cut by January 2024, and a 25% chance of a rate cut by December 2023.

Lower interest rates tend to boost the demand for gold, as they reduce the opportunity cost of holding the non-yielding metal, and weaken the value of the U.S. dollar, making gold cheaper for buyers in other currencies. Gold is also seen as a hedge against inflation and uncertainty, and a store of value in times of crisis.

Gold was also supported by the physical buying of gold by some central banks, especially from Russia and China, who were keen to diversify their reserves and reduce their dependence on the U.S. dollar. According to the World Gold Council, central banks bought 193.3 tons of gold in the third quarter of 2023, up 73% from the same period in 2020, and the highest quarterly total since the first quarter of 2019.

Gold analysts and traders expected the bullish trend in gold to continue, as the market awaited the next Fed meeting on December 12-13, 2023, where the Fed was expected to announce a faster tapering of its bond-buying program, and provide more guidance on its future rate path. Some analysts also predicted that gold could reach $2,100 or even $2,200 per ounce by the end of the year, or early next year, if the Fed surprised the market with a more dovish tone, or if the U.S. faced more economic or political shocks.

Gold was not the only precious metal that benefited from the market sentiment, as silver, platinum, and palladium also posted gains on Friday. Silver rose 0.9% to a more than six-month high of $25.47 per ounce, platinum rose 0.6% to $932.44 per ounce, and palladium rose 0.3% to $1,004.92 per ounce.